Back-to-back financing structures at risk of a Belgian withholding tax

Back-to-back financing structures and the beneficial ownership concept have been on the radar screen of many European tax administrations. Recently, a remarkable case of the Court of first instance of Leuven was published (Leuven, 27 October 2023, nr. 21/942/A) in relation to a Belgian borrower and a Dutch group financing company, which could be a turning-point in practice if it is confirmed in appeal.

1. Background

Back-to-back financing structures are quite commonplace among groups of companies in Belgium. The Belgian company contracts a loan with the group financing company located in another EU Member State (generally in Netherlands or Luxembourg), which has been funded through a corresponding loan with a group company or shareholder generally (but not always) located outside the EU.

This financing structure leads in most cases to hardly any taxation at EU level as regards the back-to-back interest payments:

- BE -> EU interest payments: a withholding tax exemption generally applies in Belgium under the applicable tax treaty or the domestic regulation derived from the transposition of the EU Interest and Royalty Directive (“IRD”). At EU group financing company’s level, these interest payments are for the most part not effectively subject to corporate income tax given the compensation that occurs tax wise with the tax-deductible interest payable due on the corresponding loan granted by the group company/shareholder located outside the EU.

- EU -> third country interest payments: no withholding tax applies insofar as the EU group financing company is a tax resident of an EU Member State, the domestic legislation of which imposes as a rule no withholding tax on the outbound interest payments (or if a withholding tax exemption applies).

It goes without saying that the tax authorities, in their audit, are very critical regarding this kind of financing structures and generally suspect a tax abuse, especially when the EU group financing company lacks economic substance or has been interposed in a structure that otherwise would not be covered by a Belgian withholding tax exemption.

Since the landmark rulings issued in 2019 by the Court of Justice of the European Union (“CJEU”) in the so-called “Danish cases” (as to interest cases, see, C‐115/16, C‐118/16, C‐119/16 and C‐299/16; as to dividend cases, see, C-116/16 and C-117/16 ), the Belgian tax authorities, in their audit, challenge the application of the Belgian withholding tax exemption stemming from the IRD (or from the Parent-Subsidiary Directive (“PSD”) as far as dividend payments are concerned) on the interest (and dividend) payments made in the framework of a back-to-back structure, and refuse its application when the taxpayer failed to demonstrate that the EU group company being the formal recipient of these payments is the actual beneficial owner within the meaning of the CJEU’s Danish cases.

In these Danish cases, it is worth pointing out that the CJEU stated with respect to the burden of proof that the national tax authorities are obliged to demonstrate that the (financing) structure is abusive. However, once they conclude that the EU group company being the formal recipient is not the beneficial owner of the payments, they are not required, according to the CJEU, to identify the entity or entities which it regards as being the beneficial owner(s).

Since the CJEU is only competent for interpretating the concepts applicable as part of the EU law, its stance in the Danish cases should by principle not be applicable with respect to the withholding tax exemptions stemming from non-EU instruments as bilateral tax treaties. However, the Court of first instance of Leuven, in its recent judgment of 27 October 2023 referred to below, ruled otherwise.

2. Judgment

Facts – A Belgian company (“BeCo”) made on 31 December 2017 interest payments for an amount of EUR 39,12m to its Dutch subsidiary acting as the group financing company (“Dutch FinCo”), in connection with 5 loans granted by the latter (i.e., loans 1A to 4A and loan 5A). BeCo claimed in its withholding tax return the withholding tax exemption as set out in Art. 11, § 3, a) of the tax treaty concluded between Netherlands and Belgium (“NL-BE tax treaty”). This withholding tax exemption is subject among others to the formal recipient company being the “beneficial owner “of the interest payments.

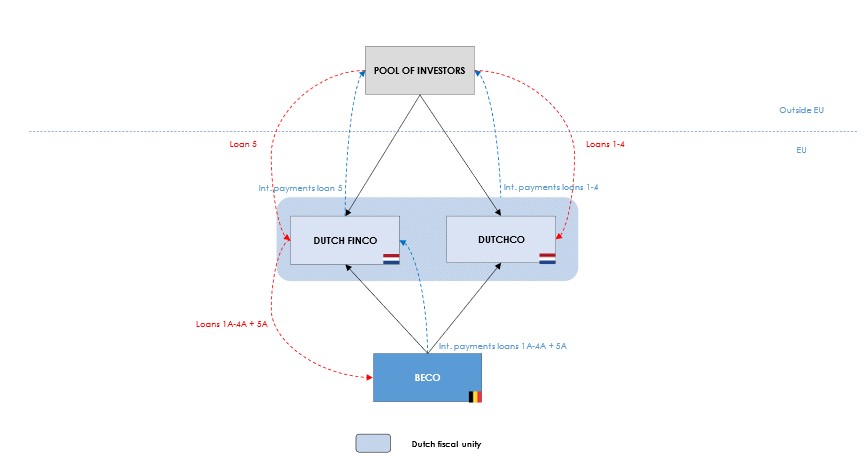

From the transfer pricing documentation available (including an advance pricing agreement with the Dutch government or “APA”), it appeared that the 5 loans granted by Dutch FinCo have been funded through 5 loans with comparable terms and conditions from a pool of investors located outside the EU (i.e., loans 1 to 4 and loan 5), presumably through a US limited partnership. Whereas all these loans have been originally contracted/granted by an EU single company, they were during the disputed period held in two distinct entities (as a result of a demerger), i.e.:

- The loans 1A-4A granted to BeCo were held by Dutch FinCo, while the corresponding funding loans 1-4 were held by another Dutch group company (“DutchCo”); and

- The loan 5A granted to BeCo and the corresponding funding loan 5 were held by Dutch FinCo on its own. Besides, the promissory note foresaw that Dutch FinCo is contractually obliged to effectively pay the interest to the pool of investors.

For illustrative purposes only since this could be not totally accurate (as we do not avail of an exhaustive description of the facts), the disputed financing structure as described in the published judgment can be schematised as follows:

The interest payments received by Dutch FinCo from BeCo in connection with the loans 1A-4A were hardly subject to tax in Netherlands during the disputed period as they were offset against the interest payable due by DutchCo on the loans 1-4 as the result of the application of the tax consolidation regime for Netherlands corporate income tax purposes (“fiscale eenheid” or “fiscal unity”). The interest payable and receivable pertaining to respectively loan 5 and loan 5A fell however outside the Dutch fiscal unity between Dutch FinCo and DutchCo for tax consolidation purposes.

Upon examination of the financing structure, the Belgian tax authorities refused the application of the withholding tax exemption as laid down by the NL-BE tax treaty on the concerned interest payments. They are of the view that BeCo failed to demonstrate that Dutch FinCo is the actual beneficial owner of the interest payments within the meaning of the NL-BE tax treaty. Besides, they considered that they are allowed to determine the withholding tax due on the interest payments on a gross-up basis since it has been agreed between the parties involved that BeCo assumes the cost of the withholding tax. BeCo obviously disagreed with the tax authorities’ stance and filed a claim before the Court of first instance of Leuven.

Burden of proof – The Court ruled that it is up to BeCo – as the taxpayer claiming the application of a tax benefit – to demonstrate that the conditions to enjoy the withholding tax exemption as set out in Art. 11, § 3, a) of the NL-BE tax treaty are met. Hence, the tax authorities would be grounded to deny the application of the withholding tax exemption should BeCo fail to demonstrate that Dutch FinCo is the actual beneficial owner of the concerned interest payments. Besides, without getting into too much detail, the burden of proof rests in any case with BeCo given the procedure under which the tax authorities have challenged the application of the withholding tax exemption in the case at hand (i.e., ex officio assessment procedure due to a late filing of BeCo’s withholding tax return).

Concept of beneficial owner – More remarkable, the judge ruled that the concept of “beneficial owner” within the meaning of the NL-BE tax treaty (concept not defined in the tax treaty itself) is to be understood, not only in the light of the OECD commentaries, but also under the IRD and the related case law.

To support its stance, the judge pointed out that the Belgian preparatory works relating to the NL-BE tax treaty referred to the IRD and that the paragraph 16 of the treaty protocol expressly stipulates that the EU Directive applies, as regards interest, notwithstanding the provisions of Article 11 paragraphs 2 and 3. In judge’s view, it is also logical in the case at hand to consider the concept of beneficial owner within the meaning of the IRD as the treaty contracting parties (i.e., Belgium and Netherlands) are both EU Member States (and hence obliged to ensure compliance with EU law) involved in the adoption of the said-Directive the negotiations of which were conducted during the same period as the ones for the NL-BE tax treaty.

Based on that reasoning, the judge considered that the concept of “beneficial owner of the interest” must be interpreted in accordance with the CJEU’s definition of this concept in the Danish cases, i.e., “as designating an entity which actually benefits from the interest that is paid to it [; in other words, not the] formally identified recipient but rather the entity which benefits economically from the interest received and accordingly has the power freely to determine the use to which it is put”.

The Court then concluded that BeCo failed to demonstrate that Dutch FinCo was the beneficial owner of the interest payments within the meaning of the IRD, and hence ruled out the application of the withholding tax exemption stemming from the NL-BE tax treaty. To come to this conclusion, the judge pointed out some elements, that can be summarised as follows, from which it can be implicitly deducted according to the latter that Dutch FinCo and DutchCo are conduit companies:

- The terms and conditions of the loans granted to BeCo were strongly similar to those taken out from the pool of investors as regards their interest rate (finance margin aside), duration and amount. As to the loans 5A and 5, they were even concluded and entered into force at the same time while the related promissory note stipulates that Dutch FinCo must effectively pay the interest due to the pool of investors.

- The primary assets of Dutch FinCo and DutchCo consist, according to the transfer pricing documentation, of the outstanding loans provided to BeCo.

- The functions performed by the Dutch fiscal unity are described in the transfer pricing documentation as the management and servicing of the loans provided to BeCo.

- The fiscal unity between Dutch FinCo and DutchCo resulted in barely any taxes being paid in Netherlands on the interest payments received from BeCo.

- The advance pricing agreement also shows the link between the loans granted to BeCo and the corresponding ones granted by the pool of investors. In this agreement, Dutch FinCo and DutchCo are referred together to as one party – "party A" –, having claims against BeCo under loans 1A to 5A, which were funded by loans 1 to 5 provided by the pool of investors. According to the judge, it is clear from this agreement that the loans and the interest related thereto are to be assessed at the level of the fiscal unity and not at the entity level.

- In the absence of the interposition of Dutch FinCo, BeCo would not be in position to claim a Belgian withholding tax exemption had it made the interest payments directly to the pool of investors.

- The fact that the loans 1A-4A and the corresponding loans 1-4 – originally concluded by one single entity – were held during the disputed period by two distinct entities because of a demerger (resulted in no back-to-back interest payments strictly speaking at Dutch FinCo’s level with respect to these loans), while the payable and receivable related thereto may notwithstanding continue to be offset for corporate income tax purposes by application of the Netherlands tax consolidation regime, showcased, in judge’s view, the artificiality of the financing structure.

Gross-up clause – The judge also had to tackle the impact of the so-called “gross-up clause” on the calculation of the amount of the Belgian withholding tax due on the concerned interest payments. The presence of a gross-up clause in loan agreements being part of a back-to-back financing structure is common practice and requires from the borrower to pay an additional amount to the lender to ensure that the latter receives the agreed interest amount irrespective the tax withheld or due in the borrower’s State.

Belgian tax law designates as a rule the beneficiary of the interest payment as the one who ultimately bears the cost of the withholding tax. In that case, the withholding tax (ordinary rate in Belgium: 30%) must be determined on the amount effectively paid by the debtor of the income (in our case: 30% of EUR 39,12m = EUR 11,73m). By derogation of this general rule, Article 268 of the Belgian Income Tax Code (“BITC”) stipulates that the withholding tax must be determined on a gross-up basis in case the debtor of the income bears the cost of the withholding tax for the beneficiary of the income (in our case, it would lead to: 30% of (EUR 39,12m * 100/70) = EUR 16,76m). Belgian case law is of the opinion that this derogatory provision may only be applied by the tax authorities when there is an express agreement between the beneficiary of the income and the debtor stipulating that the cost of the withholding tax lied with the latter notwithstanding the general rule.

In the case at hand, the question arises as to whether the standard gross-up clause included in the agreements relating to the loans 1A-4A is to be considered as an express agreement between Dutch FinCo and BeCo within the meaning of Art. 268 BITC, allowing the Belgian tax authorities to determine the withholding tax due on a gross-up basis. The judge answered to this question by the affirmative, by considering that it derives from the loan agreement and the advance pricing agreement that it was the intent of the parties to lie the cost related to the withholding tax with the debtor of the income (i.e., BeCo).

3. Takeaway

The recent ruling of the Court of first instance of Leuven commented above would constitute a turning-point in practice should it be confirmed in appeal. The traditional back-to-back financing structure – where the group financing company is in an EU Member State – would be at risk of a Belgian withholding tax irrespective whether the withholding tax exemption applicable is stemming from the national transposition of the IRD or from a bilateral tax treaty.

Based on that judgment, the EU group financing company receiving the interest payments from the Belgian borrower might be considered by the tax authorities as not being their actual beneficial owner for Belgian withholding tax exemption purposes, based on the mere fact that this EU entity has financed the loan it granted to the Belgian borrower by a corresponding loan with comparable terms and conditions from a lender outside the EU. In this regard, the fact that the EU group financing company is remunerated with an arm’s length finance margin (in the case at hand, there were a quite exhaustive transfer pricing documentation available as well as an advance pricing agreement in force) and that there were no back-to-back payments strictly speaking (as it was the case for the loans 1A-4A/1-4) seems not to be enough to secure the application of the withholding tax exemption.

This Belgian withholding tax risk would be further increased had the loan agreements foreseen a gross-up clause (which is normally the case) as the tax authorities would be allowed, based on this recent case law, to determine the withholding tax due on the interest payments on a gross-up basis, leading to a greater amount of withholding tax to be paid.

It is therefore more than ever advised to get the assistance of legal and tax professionals when drafting loan agreements in an intra-group back-to-back setup.