From bean to bar: Locating and Reporting Cocoa Supply Chain Data Under the EU Deforestation Regulation

The mandatory obligations stemming from the ‘Deforestation Regulation (EU) 2023/1115’ (EUDR), which came into force on 29 June 2023, are set to become applicable in all Member States of the European Union (EU) on 30 December 2024. Although the Regulation is directly applicable, certain Member States, such as the Netherlands for instance, have already proposed draft legislation to further implement the EUDR’s obligations. This includes removing any inconsistencies within national legislation, appointing national competent regulatory authorities, and adopting sanctions and enforcement measures.

However, there are concerns about obtaining the necessary supply chain data required by the EUDR or, in a broader sense, for the purpose of ESG due diligence and reporting.

In this post, our experts briefly discuss the recent developments regarding the implementation of the EUDR following the publication by the Commission’s guidance on obtaining cocoa supply chain data.

Recap: the EUDR

Introduction

As part of the EU Green Deal, as well as the broader EU strategy to protect the world’s forests, the EUDR aims to reduce global deforestation by minimising the EU's contribution to deforestation and forest degradation worldwide.

Deforestation - Meaning the conversion of forest to agricultural use, whether human-induced or not.

In addition, the EUDR also aims to reduce the EU’s contribution to greenhouse gas emissions and prevent global biodiversity loss. The EUDR complements existing measures that primarily address illegal timber logging, such as the ‘EU Timber Regulation’ and the ‘Forest Law Enforcement, Governance, and Trade Regulation’.

To achieve its purpose, the EUDR only allows deforestation-free commodities and products on the EU market, if these products are in-scope.

Deforestation-free

- In-scope commodities that were produced on land that has not been subject to deforestation after 31 December 2020.

- Wood that has been harvested from the forest without inducing forest degradation after 31 December 2020.

In anticipation of the date on which these obligations become applicable, in-scope companies could take certain preparatory practical actions, such as analysing internal data to enhance visibility and traceability along the value chain as well as evaluating the compliance status of existing suppliers pursuant to the EUDR.

Scope

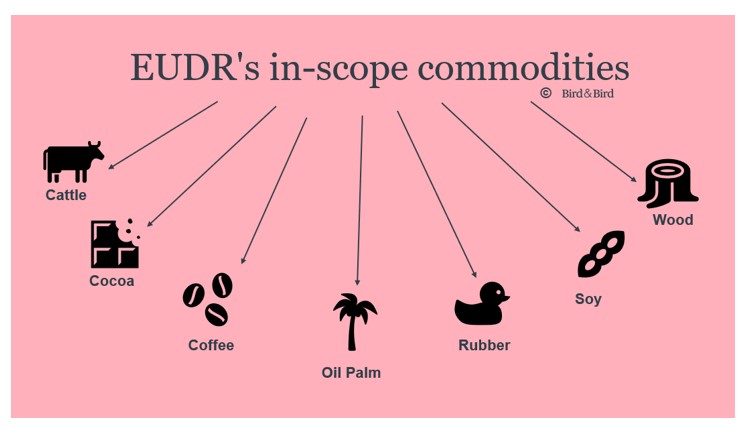

The material scope of the EUDR encompasses particular commodities identified in Article 2(1) EUDR, namely: cocoa, coffee, palm oil, soy, wood, cattle, and rubber (which list can be extended following the EUDR’s review by the Commission after a period of two years).

In addition, products that are being derived from these commodities and are listed in Annex 1 EUDR fall also within the scope of the EUDR. The production of these relevant commodities (and their derived listed products) requires a huge amount of agricultural land and is, therefore, seen as the main driver behind deforestation.

Regarding the personal scope, the EUDR applies to large 'operators' (those who place the listed product or relevant commodity on the EU market for the first time) and 'traders' (those who make the listed product or relevant commodity further available to the market). the EUDR applies to these market participants, regardless of the location of their legal establishment and their legal form. However, a special (less stringent) regime applies to ‘small and medium-sized enterprises’ (SMEs), which becomes applicable after 30 June 2025.

Take-aways

- Determine whether your raw materials or derived products fall within the scope of the EUDR;

- Assess whether you place relevant commodities or listed products for the first time on the EU market or make them further available on the EU market

Obligations

Briefly put, Article 3 EUDR provides that in-scope products or commodities cannot be placed on the EU-market, unless they are:

- Deforestation-free;

- Legally produced; and (as procedural requirement)

- Accompanied by a ‘due diligence statement’ (DDS).

Regarding the DDS, the EUDR outlines three main steps for compliance:

- gather geographic data, such as satellite imagery;

- assessing the risk of non-compliance with the EU deforestation-free standards pursuant to Article 10(2) EUDR;

- implementing measures to mitigate identified risks to negligible levels.

The ‘risk assessment’ within the meaning of Article 10(2) EUDR must meet the information requirements pursuant to Article 9 EUDR. Moreover, the EU has designed a so-called benchmarking mechanism. By the end of 30 December 2024, the Commission must draw up a list of low, standard, and high-risk producing countries based on the likelihood of deforestation and the will of local authorities to actively combat it. Subsequently, 1%, 3% or 9% of imports from those countries will be checked, respectively. These checks will be done at the border by customs. If importers do not comply, they will not be allowed to sell their products on the internal market and risk a fine.

In addition, the risk assessment regarding ‘relevant products’ must indicate that the risk of the concerned products/commodities not being deforestation-free or legally produced is absent or at least negligible. Only then, the EUDR allows the ‘relevant products’ concerned to be placed on the EU market. Unfortunately, ‘negligible’ has not been defined by the European legislator.

Operators and non-SME traders may only reach a conclusion on ‘negligible risk’ for the relevant product concerned as a result of conducting a full due diligence pursuant to Articles 4(1), 8, and 10(2). In that regard, the EUDR does not provide a categorial exemption of (in-scope) ‘negligible risks products’ from its mandatory due diligence obligation.

In addition, it follows from the Commission’s latest FAQ (dated December 2023), that the ‘negligible risk’ aspect does not relate to commodities themselves. The EUDR does provide a benchmarking system for commodities. However, this benchmarking system only determines whether the country of origin is classified as either a low-risk country (thus requiring simplified due diligence) or a high-risk country (thus mandating more in-depth due diligence); the benchmarking system does not address whether the commodity itself should be perceived as a ‘negligible risk commodity’.

Interestingly, the EUDR applies retrospectively by requiring that the concerned product must not have originated from land subjected to deforestation or forest degradation after 31 December 2020. This early cut-off date is based on New York Declaration on Forests, which follows the UN 2015 Sustainable Development Goals (SDGs) to stop further global deforestation. Following these soft law instruments and in light of the EU’s precautionary principle, this early cut-off date was set to prevent further deforestation during the legislative process and to minimise disruptions to global supply chains.

Enforcement

To ensure supervision and enforcement of the EUDR’s obligations, Member States must appoint national authorities, who will check the due diligence statements, and are competent to conduct inspections and impose sanctions when necessary. The sanctions regime to be implemented by Member States is required to include administrative fines, the maximum amount of which shall be at least 4% of the infringing operator’s or trader’s total annual Union-wide turnover in the financial year preceding the fining decision. Furthermore, Member States must implement additional enforcement measures, such as confiscation, freezing of goods, compulsory donation or even destruction. Moreover, the EUDR introduces a ‘naming and shaming’ provision, which allows the Commission to publish on its website a list of final judgments against legal persons for infringements of the EUDR, including the penalties imposed on them.

In addition, sanctions for non-compliance with the EUDR has also been provided for in Article 3(2)(p) of the new Environmental Crime Directive, which entered into force on 20 May 2024. In brief, this Directive obliges Member States to ensure that a violation of Article 3 EUDR constitutes a criminal offense if the conduct is unlawful and intentional.

Guidance on cocoa

Recently the Commission published a guidance page for one of the in-scope commodities under the EUDR, namely cocoa. It is not yet clear whether the Commission intends to issue similar guidance for other in-scope commodities or whether it assumes that the cocoa guidance will be taken as more broadly applicable.

To illustrate the due diligence requirements down the supply chain, the Commission provided guidance for cocoa (products) in the entire supply chain as depicted in the figure below:

Firstly, the cocoa must be produced legally in accordance with the rules of the land of origin and be deforestation-free. To prove this, the producer must collect the geolocation data of the area of production. Important to note is that unlike previous EU legislation concerning illegal logging and associated trade (such as the EU Timber Regulation), the EUDR addresses deforestation that is legally permitted under the laws of the producing country. The Regulation references a study by the Forest Policy Trade and Finance Initiative, which indicates that approximately 30% of deforestation for commercial agriculture in tropical nations between 2013 and 2019 was lawful.

Secondly, these deforestation-free and legally produced cocoa beans must be kept separate from other cocoa beans, which are either non-compliant or have not been subject to a compliance assessment.

Thirdly, the compliant cocoa beans must also be kept separate during the shipping. If they are not kept separate while shipping, the whole shipment will be seen as non-compliant and cannot enter the market of the Union.

Fourthly, before the product can be placed on the EU market, the importer must perform a due diligence after which he will receive a reference number for the customs declaration. Once the cocoa product has been released for import by the customs authorities, the product can be placed on the EU market.

Fifthly, large manufacturers of cocoa in EU factories must also check the due diligence statement of the importer as well as submit their own due diligence statement for their products by using the reference number of the upstream statement.

Sixthly, before selling the product on the EU market or exporting it outside the EU, large companies must perform due diligence. They must not only check the statements made throughout the entire supply chain but also submit their own due diligence statement, based on all the previous reference numbers. Once a new due diligence statement reference number and security token is given the product can be sold. SMEs do not have to check nor submit any of those statements.

Future development and critics

Many uncertainties linger regarding the application of the new regime established by the EUDR. To start with, seven Member States question the EUDR’s implementation both in scope and timing. This initiative, dated 21 March 2024, was initiated by Austria and soon received support from Finland, Italy, Poland, Slovakia, Sweden and Slovenia. It advocates for reducing the burden of proof and providing exceptions for imports from countries where the risk of deforestation is low. They also request a delay in the implementation of the Regulation, which is currently set to take effect by 30 December 2024.

Furthermore, according to Reuters, around twenty Member States are said to show understanding for postponing the applicability of the EUDR’s material provisions. Moreover, they ask for workable solutions for the implementation of the Regulation. If such solutions are not forthcoming, they do not rule out the possibility of a serious disruption in the supply of essential goods for the European market, such as food, animal feed, and biofuels. Hence, environmental organisations issued an open letter, dated 28 March 2024, to the European Commission to actively involve all stakeholders in the chain in this process and not cause further delay to the intended implementation of the EUDR.

In addition, the sector itself is also concerned about becoming compliant with the EUDR. Compliance is not just a challenge for importers within the EU, but also for producers outside the Union. It takes time and technical investment to map the data. Not all small farmers would be able or willing to do that, due to financial restraints. According to the Federation of Dutch Food Industry, this could result in their exclusion from the EU market. The strict rules would then force them to find other markets. Finally, even though small companies need to provide less information than large importers and processors, the industry associations say it is still unclear exactly what information needs to be shared with trading partners.

Concluding remarks

In conclusion, the EUDR could be regarded the EU’s first major directly applicable material ESG regulation. However, its far-reaching due diligence requirements give raise to concerns on ensuring effective compliance.

Although the Commission provided guidance with regard to the due diligence requirements in the cocoa supply chain, it remains difficult to ensure compliance further down the supply chain. This is particularly true as regards compliance by small third parties or complex processes outside the direct influence of the operator or trader. Smaller parties further down the supply chain could be not equipped and/or willing to cooperate with the operator’s or traders’ due diligence requirements. Other problems are more of a practical nature, such as the requirement of separate storage and shipment of compliant goods. This may work for large companies when it concerns their own business activities, but it can be a burden for third parties. Also, it remains unclear to which extent technical measures are deemed compatible with the EUDR to fulfil these obligations in an efficient and pragmatic way.

In addition, not all information requirements can be deemed sufficient in light of the EUDR’s rationale. For instance, cocoa farmers could cut down the indigenous (primordial) forest and replace it with new trees to provide the necessary shade for growing cocoa trees. This practice undermines the rationale of the EUDR. The problem is that the required satellite images do not tell anything about the actual trees that are growing. Additionally, obtaining other geographical data takes time and is very intensive. Although technology could be useful, it remains unclear which of these technologies will be deemed adequate by the Commission or the competent regulatory authorities. It is, therefore, up to the Commission to provide more guidance on this matter.

Finally, in light of these compliance concerns raised by both the sector and certain Member States, it remains uncertain whether Member States are going to strictly monitor and enforce the obligations of the EUDR right away or provide some degree of leniency during a transition or ‘grace period’.

Curious how ESG, including the EUDR, impacts businesses in the agri-food sector? Join our interactive round table conversation with ESG stakeholders and our ESG specialists in Brussels or reach out directly to our experts Pauline Kuipers, Nicolas Carbonnelle, and Sander Wagemakers.

Interested in exploring whether your blockchain solution for ensuring EUDR compliance, or for monitoring sustainability supply chain data on deforestation, is in accordance with EU ESG regulations? Click here for more information on participating in the European Commission’s Regulatory Sandbox Project.